Cash vs. Credit: Pros and Cons of Each Car Buying Method

When deciding between cash and credit for a car purchase, there are pros and cons to consider. Cash offers immediate ownership and eliminates interest payments, while credit provides affordability and the opportunity to build credit history. Budget, savings, interest rates, and loan terms should be taken into account. It's also important to research market prices and understand financing options when negotiating a better deal. Ultimately, the right car buying method will depend on individual circumstances and preferences.

Cash Payment Benefits

Cash payment benefits include immediate ownership of the car without any need for financing or loans. By paying in cash, buyers can also eliminate interest payments and avoid long-term financial commitments.

Credit Financing Advantages

Credit financing advantages include the ability to spread out payments over a longer period, making a more expensive car affordable. It can also help build credit history and provide additional protection through warranties and insurance options.

Advantages of Cash Buying

Advantages of Cash Buying: Paying with cash for a car offers immediate ownership without the burden of interest payments, providing the buyer with full control and ownership of the vehicle.

Immediate Ownership

When paying with cash, buyers gain immediate ownership of the car. They don't have to wait for loan approvals or worry about any ongoing financial obligations related to the purchase.

No Interest Payments

When buying a car with cash, there are no interest payments to worry about. This can save buyers thousands of dollars over time and make the purchase more affordable in the long run.

Benefits of Credit Buying

One of the benefits of credit buying a car is the affordability and flexibility it offers. It allows buyers to spread out the payments over time, making it easier to manage their finances.

Affordability and Flexibility

When it comes to credit buying a car, one of the major benefits is the affordability and flexibility it offers. Buyers can spread out their payments over time, making it easier to manage their finances and fit the car purchase into their budget.

Building Credit History

Building credit history is a significant advantage of credit buying. By making timely payments on a car loan, individuals can establish and improve their credit scores, which can be beneficial for future financing opportunities.

Factors to Consider Before Choosing Between Cash and Credit

Before deciding between cash and credit for buying a car, individuals should consider their budget and savings, as well as the interest rates and loan terms offered by lenders.

Budget and Savings

Before choosing between cash and credit for buying a car, individuals should consider their budget and savings. This will help them determine how much they can afford to spend upfront or how much they can comfortably pay back over time.

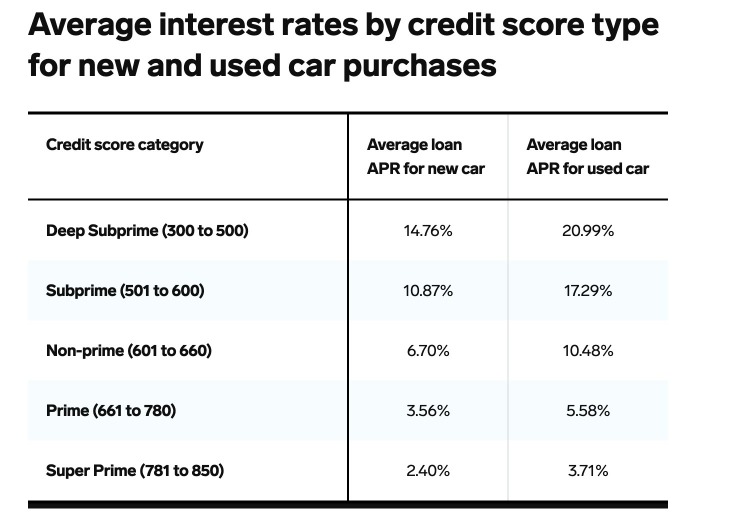

Interest Rates and Loan Terms

When deciding between cash and credit for car buying, it's important to consider interest rates and loan terms. Higher interest rates can increase the cost of borrowing, while longer loan terms can extend the repayment period.

Tips for Negotiating a Better Deal

When negotiating a car purchase, it is important to do your research and understand your financing options. Here are some tips to help you negotiate a better deal:

- Research market prices: Before going to the dealership, research the average price of the car you are interested in. This will give you an idea of what a fair price would be and help you negotiate effectively.

- Understand financing options: Familiarize yourself with different financing options available to you. This can help you compare offers and negotiate better terms.

- Be prepared to walk away: Don't be afraid to walk away if the deal isn't to your liking. This shows the salesperson that you are serious about getting the best deal and they may be more willing to negotiate.

- Ask for discounts: Inquire about any discounts or promotions that may be available, such as manufacturer rebates or dealership incentives. These can help lower the overall cost of the car.

- Negotiate the interest rate: If you are financing the car, negotiate the interest rate with the lender. A lower interest rate can significantly reduce the total cost of the loan.

- Consider add-ons and extras: Be cautious when considering add-ons and extras, such as extended warranties or additional features. These can increase the overall cost of the car and may not be necessary.

Remember, negotiation is a key part of the car buying process. With proper preparation and knowledge, you can negotiate a better deal and save money on your purchase.

Researching Market Prices

Before heading to the dealership, it is essential to research the average price of the car you're interested in. This knowledge will help you negotiate effectively and ensure you're getting a fair deal.

Understanding Financing Options

Understanding Financing Options: Research different financing options available, such as bank loans, dealership financing, or leasing. Compare interest rates, terms, and monthly payments to determine the best option for your financial situation.

Conclusion

In conclusion, when deciding between cash or credit buying methods for a car, it is important to consider your financial situation and goals. Researching and comparing options will help you make an informed decision.

Choosing the Right Car Buying Method: Cash or Credit

When it comes to choosing the right car buying method, whether it is cash or credit, it all depends on your individual financial situation and goals. Take the time to evaluate your budget, savings, and interest rates, and consider the benefits and advantages of both options. Finally, negotiate a better deal by researching market prices and understanding financing options. Make an informed decision based on all these factors to determine the best car buying method for you.

Top Considerations and Final Recommendations

When considering the best car buying method, it is crucial to evaluate your budget, savings, and interest rates. It is also important to research market prices and understand financing options to negotiate a better deal. Ultimately, the decision between cash and credit will depend on your individual financial situation and goals. Make sure to carefully weigh the benefits of immediate ownership and no interest payments with cash buying against the affordability and credit-building advantages of credit buying. Consider all these factors to make the best decision for your situation.