Introduction

Introduction:

Understanding the importance of setting a car buying budget is crucial before embarking on the journey to purchase a vehicle. By carefully considering factors such as financial situation, additional costs, and researching car prices, individuals can determine a realistic budget that aligns with their needs and financial capabilities. This step-by-step process will guide potential car buyers in making informed decisions and avoiding financial strain in the long run.

Understanding the importance of setting a car buying budget

Setting a car buying budget is essential for several reasons. It helps individuals avoid overspending and getting into debt, ensuring they can comfortably afford their monthly car payments. It also allows them to prioritize their needs and make informed decisions while selecting a vehicle. By setting a budget, individuals can make wise financial choices and protect their overall financial well-being.

Factors to consider before calculating your car buying budget

Before calculating your car buying budget, there are several factors you need to consider. These include your current financial situation, including your income and expenses, as well as any existing debts or financial obligations. Additionally, you should think about your long-term financial goals, such as saving for retirement or a down payment on a house. Finally, take into account your personal preferences and needs when it comes to the type and features of the car you want to purchase. By considering these factors, you can ensure that your car buying budget aligns with your overall financial situation and goals.

Assess Your Financial Situation

Assessing your financial situation is a crucial step in calculating your car buying budget. Start by analyzing your current income and expenses to determine how much you can comfortably afford to spend on a car payment each month. Consider any existing debts and financial obligations, as well as your long-term financial goals. This will help ensure that your car purchase aligns with your overall financial situation and objectives.

Analyzing your current income and expenses

When calculating your car buying budget, it's important to analyze your current income and expenses. Take a close look at your monthly income and deduct any fixed expenses such as rent/mortgage, utilities, and groceries. Also, consider any variable expenses like entertainment and dining out. This analysis will give you a clear picture of how much you can comfortably allocate towards your car payment each month.

Determining your monthly car payment affordability

Determining your monthly car payment affordability is crucial in setting a realistic car buying budget. Consider your current income, expenses, and any other financial obligations. Calculate the maximum amount you can comfortably allocate towards a car payment each month. This will help you determine the price range of cars you can afford.

Consider Other Costs

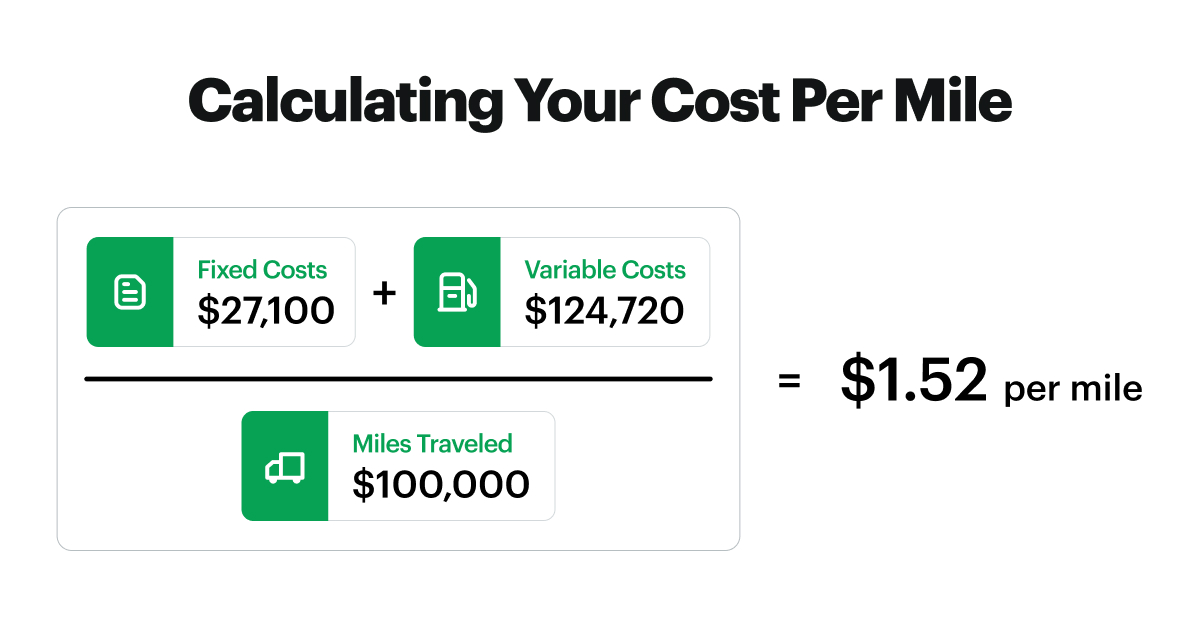

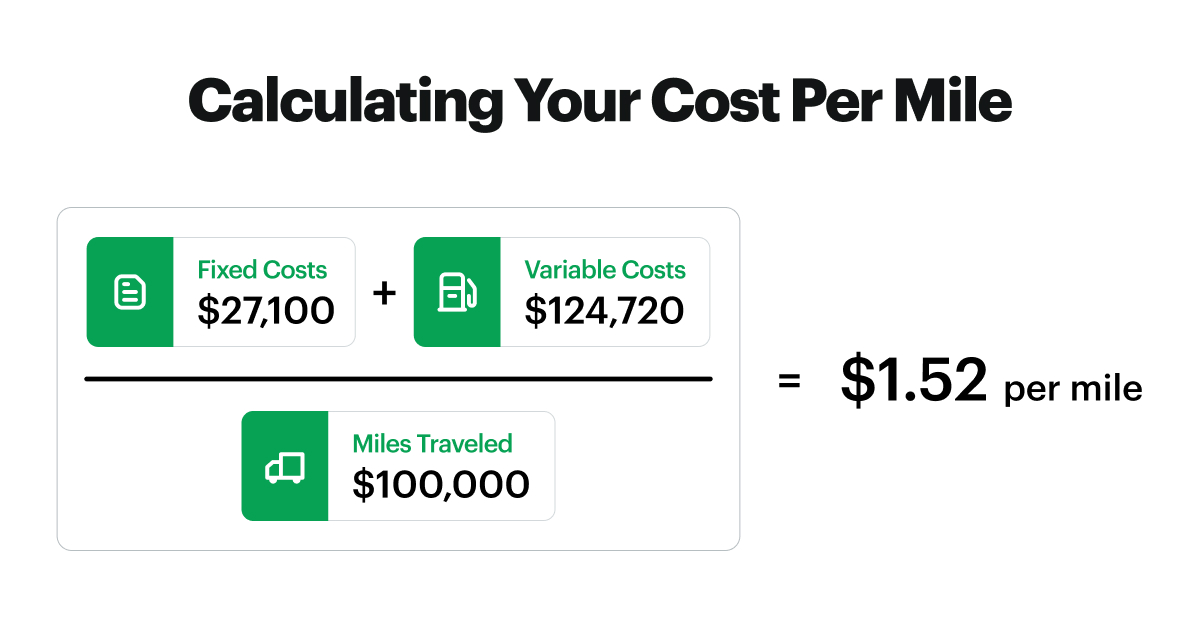

When calculating your car buying budget, it's important to consider other costs beyond just the car payment. These additional expenses include insurance, fuel, and maintenance. Factoring in these costs will give you a more realistic idea of how much you can afford to spend on a car each month. Additionally, it's important to budget for unexpected car repairs, as they can add significant expenses. Keep these costs in mind to ensure you have a comprehensive budget for your car buying journey.

Factoring in additional expenses like insurance, fuel, and maintenance

When calculating your car buying budget, it's important to consider other costs beyond just the car payment. These additional expenses include insurance, fuel, and maintenance. Factoring in these costs will give you a more realistic idea of how much you can afford to spend on a car each month. Additionally, it's important to budget for unexpected car repairs, as they can add significant expenses. Keep these costs in mind to ensure you have a comprehensive budget for your car buying journey.

Budgeting for unexpected car repairs

When calculating your car buying budget, it's crucial to budget for unexpected car repairs. Car repairs can be costly and can occur unexpectedly, so it's important to set aside some funds specifically for this purpose. By budgeting for unexpected car repairs, you can ensure that you are financially prepared for any unforeseen expenses that may arise during your car ownership.

Research Car Prices

When researching car prices, it is important to gather factual data on the average prices of cars within your desired range. This can be done through online resources, dealership websites, or by consulting with car buying guides. Take note of any variations in prices based on factors such as the car's condition, mileage, and features. Researching car prices will help you set a realistic budget and negotiate better deals with sellers.

Examining the average prices of cars within your desired range

To determine the average prices of cars within your desired range, it is crucial to gather factual data from reliable sources. This can include consulting online resources, dealership websites, or car buying guides. Take note of the variations in prices based on factors like the car's condition, mileage, and features. This research will enable you to set a realistic budget and negotiate better deals with sellers.

Exploring financing options and interest rates

When calculating your car buying budget, it's important to explore financing options and interest rates. Shop around for different lenders and compare their offerings. Consider factors such as the loan term, interest rate, and monthly payment to find the best option for your financial situation. This will help you determine the total cost of financing and adjust your budget accordingly.

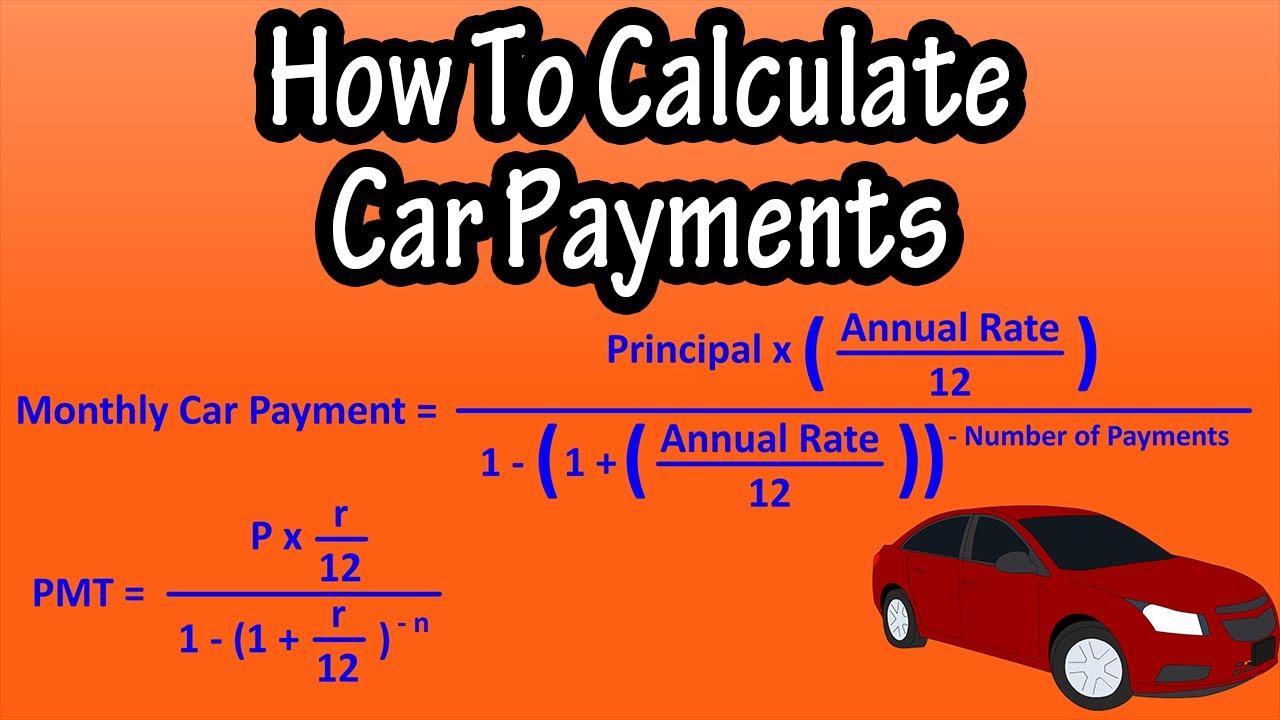

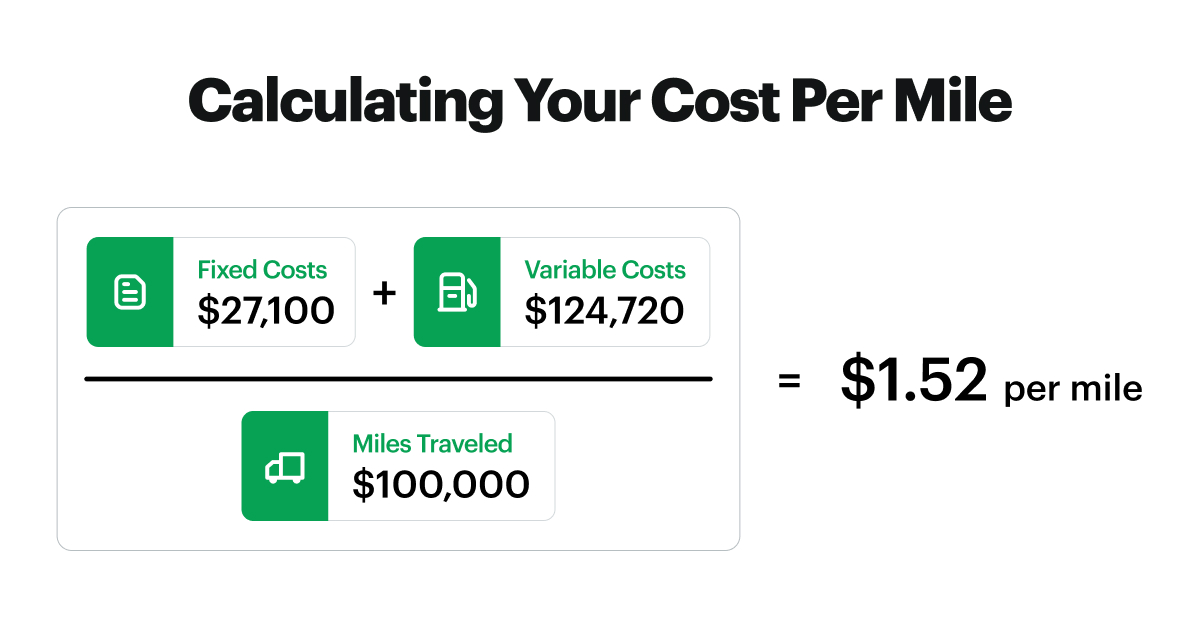

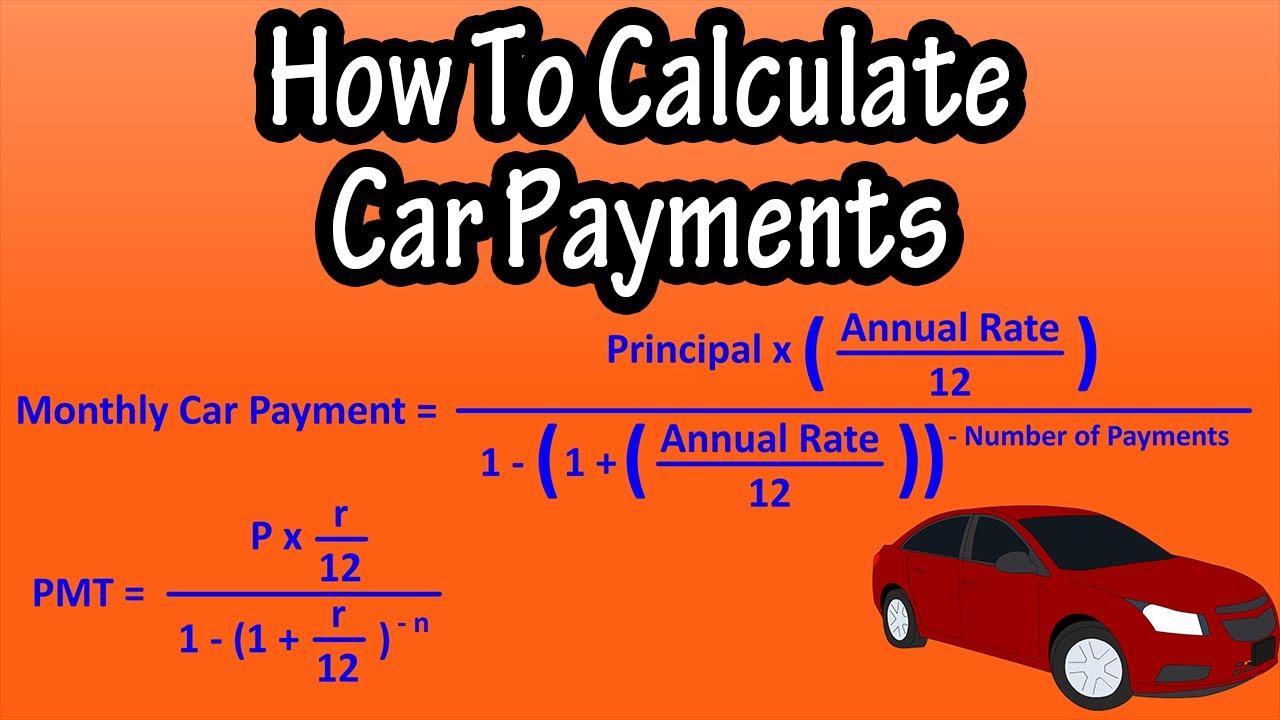

Estimating Monthly Payments

Estimating monthly car payments is a crucial step in calculating your car buying budget. Utilize online car loan calculators to input factors such as loan amount, interest rate, and loan term to get an estimate of your monthly payments. Evaluate different loan terms and down payment options to find the option that best fits your budget.

Utilizing online car loan calculators

When estimating monthly car payments, it is beneficial to utilize online car loan calculators. These calculators allow you to input factors such as loan amount, interest rate, and loan term to get an estimate of your monthly payments. By experimenting with different loan terms and down payment options, you can find the option that best fits your budget. This interactive tool simplifies the process of calculating your car buying budget and helps you make informed decisions.

Evaluating different loan terms and down payment options

When estimating monthly car payments, it is important to evaluate different loan terms and down payment options. By adjusting the length of the loan term, you can determine how much interest you will pay in the long run. Additionally, considering a larger down payment can lower both your monthly payments and overall interest costs. Use online loan calculators to compare different scenarios and find the option that best fits your budget.

Adjusting Your Budget

Once you have calculated your car buying budget, it may be necessary to make adjustments. Evaluate your calculations and consider if you need to make any changes to meet your financial goals. This could involve increasing your down payment, choosing a shorter loan term, or exploring different car options. Remember to regularly reevaluate your budget to ensure you stay on track.

Making necessary adjustments based on your calculations

Based on the calculations of your car buying budget, it may be necessary to make adjustments to meet your financial goals. This could involve increasing your down payment, choosing a shorter loan term, or exploring different car options within your budget. Regularly reevaluating your budget will ensure that you stay on track and make any necessary tweaks along the way.

Reevaluating your budget periodically

Reevaluating your budget periodically is crucial to ensure that you stay on track with your financial goals. As your income and expenses may change over time, it is important to reassess your budget to make any necessary adjustments. Regularly reviewing your budget will help you to identify areas where you can cut back or allocate more funds for your car buying budget. It is recommended to revisit your budget at least once a year or whenever there are significant changes in your financial situation. This will help you stay organized and make informed decisions when it comes to purchasing a car.

Conclusion

In conclusion, calculating your car buying budget is a crucial step in ensuring a successful and financially responsible purchase. By assessing your financial situation, considering additional costs, researching car prices, and estimating monthly payments, you can determine a budget that aligns with your needs and affordability. Remember to regularly reevaluate your budget to stay on track with your financial goals and make informed decisions.

Summarizing the steps for calculating your car buying budget

To calculate your car buying budget, start by assessing your financial situation, analyzing your income and expenses, and determining your monthly car payment affordability. Consider additional costs like insurance, fuel, and maintenance, and budget for unexpected car repairs. Research car prices and financing options, and estimate monthly payments using online calculators. Adjust your budget as needed and periodically reevaluate it for financial success in your car buying journey.

Final tips for a successful car buying experience

To ensure a successful car buying experience, it is important to follow these tips:

- Do thorough research on the car model, pricing, and financing options.

- Consider pre-approved loan options to secure a competitive interest rate.

- Take the car for a test drive and have it inspected by a trusted mechanic.

- Negotiate the price and terms with the seller or dealership.

- Carefully review and understand the contract before signing.

- Consider purchasing additional warranty or insurance coverage for added protection.

- Stick to your budget and avoid purchasing unnecessary add-ons.

- Be patient and don't rush into a decision, as it's essential to find the right car that meets your needs and fits your budget.

By following these tips, you can maximize your chances of making a smart and successful car buying decision.